Max To Invest In Traditional Ira 2025. For 2025, 2025, 2025 and 2019, the total contributions you. Here's what you need to know about traditional ira income limits in 2025 and 2025.

The cap applies to contributions made across all iras. The roth ira contribution limit for 2025 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older.

The roth ira contribution limit for 2025 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older.

What Is The Limit For Ira Contributions In 2025 Ilysa Leanora, Here's how much you can contribute to your ira in 2025, 2025, and 2025. The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 tax year was $6,500 or $7,500 if you were age 50 or older.

Max Ira Contribution 2025 Dalia Estrella, $6,500 ($7,500 if you're age 50 or older), or. $7,000 if you're younger than age 50.

Catch Up Contributions For Simple Ira 2025 Sasha Costanza, The roth ira contribution limit for 2025 is $7,000 for those under 50 and up to $8,000 for those 50 or older. Anyone age 50 or over is eligible for an additional.

A Roth IRA’s Many Benefits The Life Financial Group, Inc., Plus, find out whether you'll be able to deduct these from your taxes this year. Anyone with earned income can contribute to a traditional ira, but your income may limit your ability to.

Contribution Limits Increase for Tax Year 2025 For Traditional IRAs, This data feed is not available at this time. For both traditional and roth ira s, you can contribute up to $7,000 for 2025, up from $6,500 in 2025.

Pin on Savings To The Max., $7,500 per taxpayer 50 and older. Plus, find out whether you'll be able to deduct these from your taxes this year.

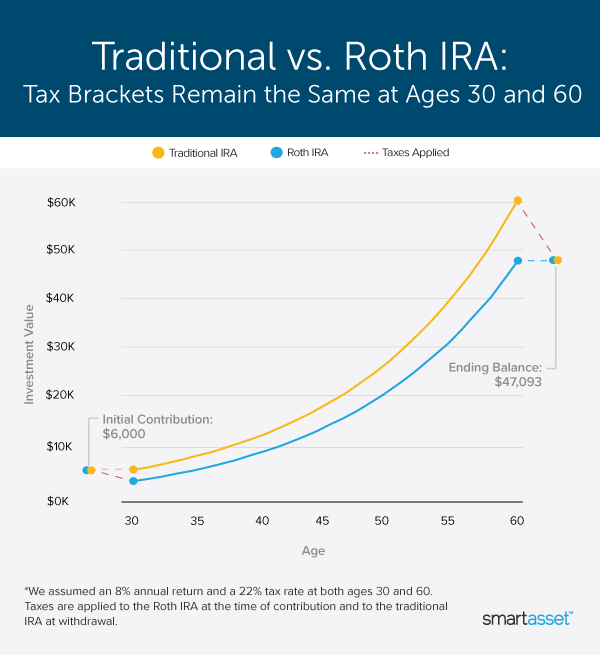

These Charts Show How Traditional IRAs and Roth IRAs Stack Up Against, This data feed is not available at this time. After all, the roth ira.

Roth Ira Max Contribution 2025 Over 50 Fae Kittie, The roth ira contribution limit for 2025 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older. Here's what you need to know about traditional ira income limits in 2025 and 2025.

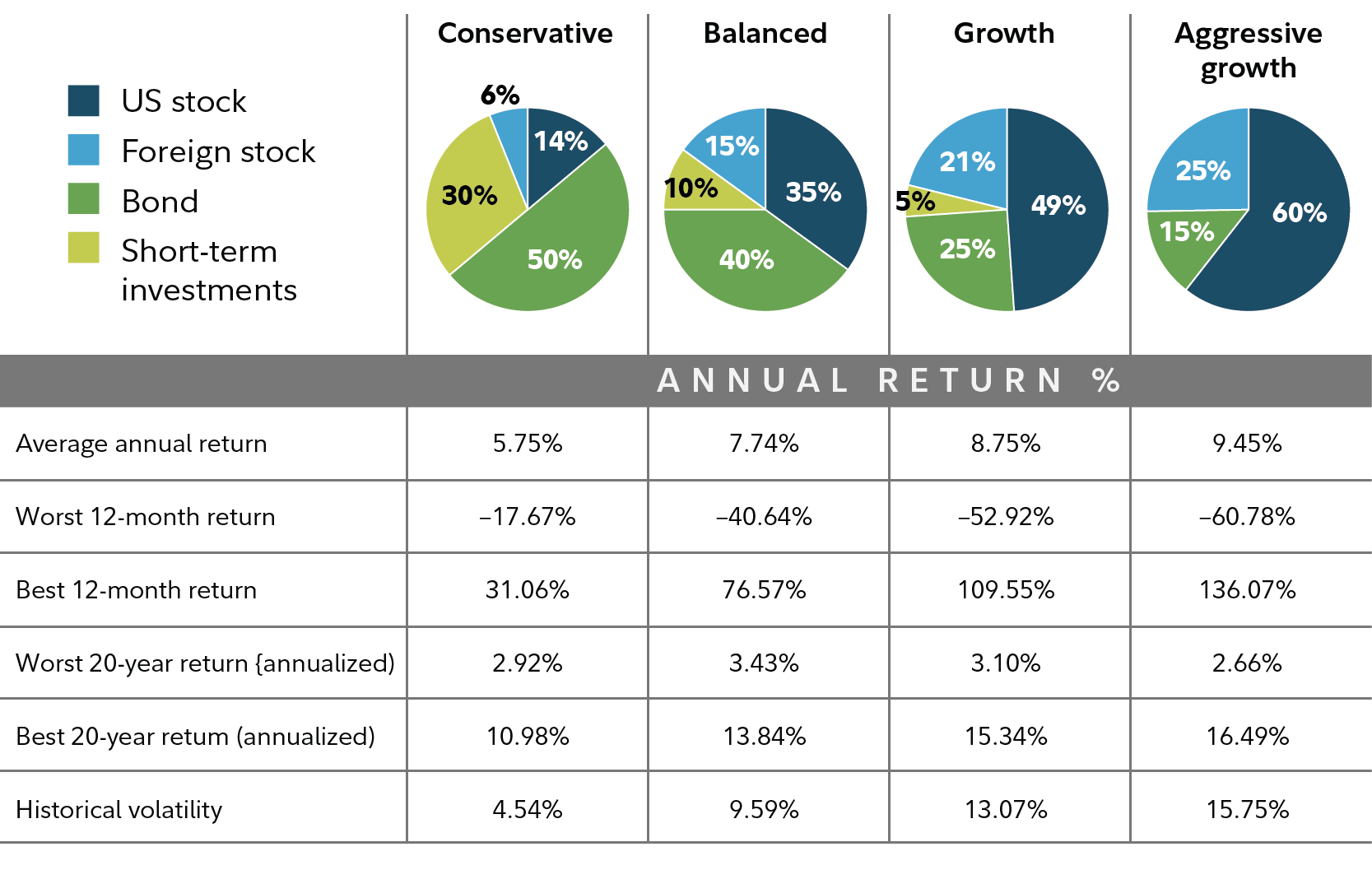

How to invest your IRA and Roth IRA Fidelity, Traditional and roth iras can be used to set aside as much as $7,000 for retirement in 2025, or $8,000 for older savers. The maximum contribution limit for roth and traditional iras for 2025 is:

Ira 2025 Ireland Wynny Morena, The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. After all, the roth ira.

The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 tax year was $6,500 or $7,500 if you were age 50 or older.