Ira Limits 2025 Catch Up 2025. See traditional ira contribution limits as well as roth ira, cesa, hsa, individual solo 401(k), simple, and sep. The 2025 ira contribution limit remains $7,000, the same as in 2025.

In 2025, that limit is $16,500. The maximum contribution for iras and roth iras remains at $7,000, same as 2025.

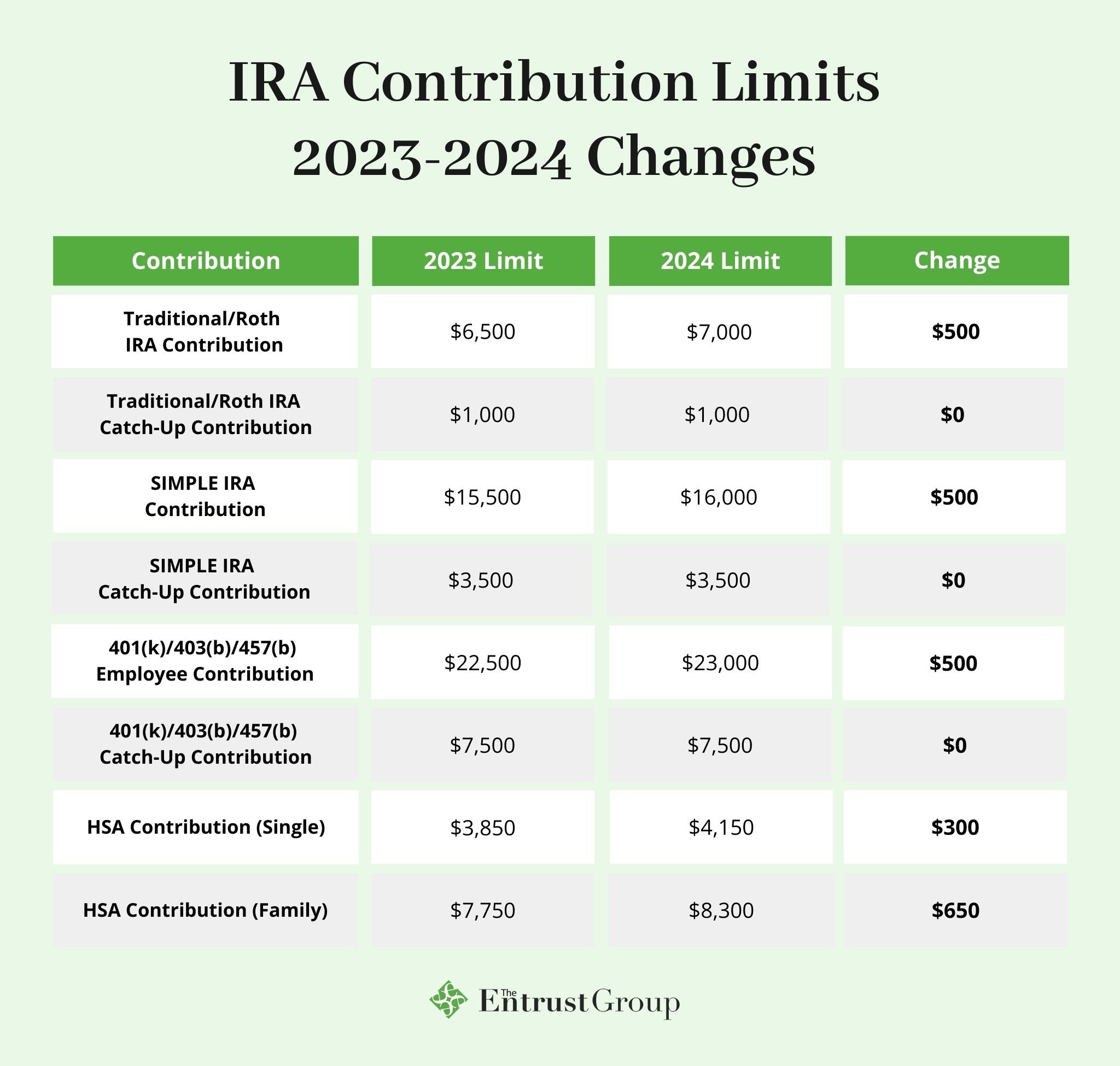

Ira Catch Up Contribution Limits 2025 Carry Crystal, For an ira, you’re able to contribute an extra $1,000 each year as of 2025, which means you can contribute a total of $8,000 per year after.

2025 Simple Ira Contribution Limits 2025 Danna Yoshiko, Savers over 50 may contribute an additional $1,000, also the same as in 2025.

Ira Contribution Catch Up Limits 2025 Celle Pattie, For 2025, individuals can contribute up to $23,000 to their 401(k), 403(b), most 457 plans, and the federal government’s thrift savings plan (tsp), an increase from last year’s.

Simple Ira Catch Up Contributions 2025 Gerda Patrica, For 2025, individuals can contribute up to $23,000 to their 401(k), 403(b), most 457 plans, and the federal government’s thrift savings plan (tsp), an increase from last year’s.

401k Catch Up 2025 Roth Contribution Limits Sande Cordelia, For 2025, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2025.

Roth Ira Eligibility Limits 2025 Catch Up Jaime Lillian, For an ira, you’re able to contribute an extra $1,000 each year as of 2025, which means you can contribute a total of $8,000 per year after.

Roth Ira Catch Up Contribution Limits 2025 Celka Clarine, The 2025 simple ira contribution limit for employees is $16,000.

Roth Ira Limits 2025 Catch Up Audrey Nicholle, Traditional ira contribution limits are up $500 in 2025 to $7,000.